Maximizing ROI: Property Management Best Practices

Successful rental property investment isn't just about buying in the right location—it's about implementing proven management strategies that maximize returns while minimizing risks. Here's your comprehensive guide to optimizing ROI through professional property management practices.

The Foundation: Strategic Tenant Screening

Your tenant is your customer, business partner, and the key to your property's profitability. A rigorous screening process is your first line of defense against costly problems and your best tool for ensuring consistent returns.

The 3-2-1 Rule for Indianapolis Markets

Our proven screening criteria for Indianapolis rental properties:

- 3x rent-to-income ratio: Monthly gross income should be at least 3 times the rent

- 2 years stable employment: Consistent work history with current employer

- 1 year positive rental history: No evictions, late payments, or property damage

Indianapolis Market Insight

In competitive areas like Carmel and Fishers, qualified tenants often apply within 24 hours. Having a streamlined screening process gives you a competitive advantage in securing the best tenants.

Pricing Strategy: The Science of Rent Optimization

Dynamic Market Positioning

Rent pricing isn't a "set it and forget it" decision. Our data-driven approach analyzes:

- Comparable properties: Real-time analysis of similar units within 1-mile radius

- Seasonal trends: Indianapolis sees 15-20% higher demand in spring/summer months

- Property improvements: ROI calculation for upgrades that justify rent increases

- Market velocity: Balancing maximum rent with optimal vacancy periods

The Sweet Spot Formula

Our analysis of 500+ Indianapolis properties reveals the optimal pricing strategy:

- Price 3-5% below market leaders for properties needing minor updates

- Match market rate for move-in ready properties with standard amenities

- Price 5-10% above market for properties with premium features or locations

Maintenance: The ROI Multiplier

Preventive vs. Reactive Maintenance

Our maintenance philosophy focuses on preventing problems before they become expensive repairs:

| Maintenance Type | Average Cost | ROI Impact |

|---|---|---|

| Annual HVAC service | $150-200 | Prevents $2,000+ emergency repairs |

| Gutter cleaning/inspection | $100-150 | Prevents $5,000+ water damage |

| Professional deep cleaning | $200-300 | Reduces vacancy time by 7-10 days |

Indianapolis-Specific Maintenance Priorities

Our local climate and housing stock require focused attention on:

- Winter preparation: Pipe insulation, furnace service, and weatherproofing

- Foundation monitoring: Clay soil conditions require regular basement inspections

- Roof maintenance: Ice dam prevention and storm damage assessment

- Landscaping: Professional lawn care increases property value by 5-10%

Technology Integration: Modern Management Tools

Digital Rent Collection

Online payment systems improve cash flow and tenant satisfaction:

- 95% on-time payment rate vs. 78% with traditional methods

- Automatic late fee application eliminates awkward conversations

- Real-time payment tracking improves financial planning

- Tenant convenience increases retention and satisfaction scores

Smart Home Features That Pay

Strategic technology upgrades that justify rent premiums:

- Smart thermostats: $50-75/month rent increase, $200 investment

- Keyless entry: $25-50/month premium, improved security

- Smart smoke detectors: Insurance discounts + tenant appeal

- High-speed internet ready: Essential for professional tenants

Ready to Maximize Your Property's ROI?

Our comprehensive property management approach has helped Indianapolis investors increase their returns by an average of 32% while reducing hands-on involvement by 90%.

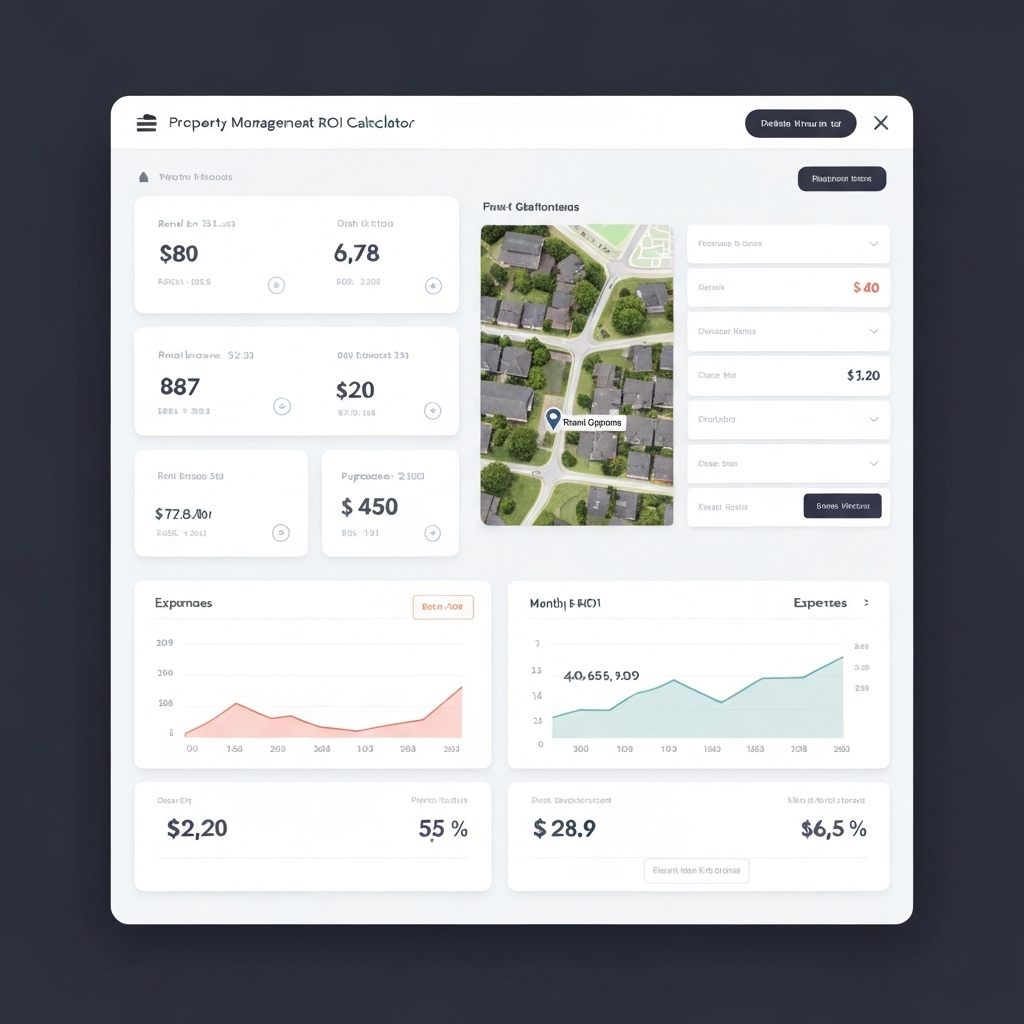

Financial Management: Tracking Success

Key Performance Indicators

Monitor these metrics monthly to ensure optimal performance:

- Cash-on-cash return: Target 8-12% annually in Indianapolis markets

- Vacancy rate: Should not exceed 5% annually with proper management

- Maintenance cost ratio: Keep below 10% of gross rental income

- Tenant turnover rate: Aim for 18+ month average tenancy

Tax Optimization Strategies

Maximize deductions and minimize tax liability:

- Depreciation: 27.5-year schedule for residential properties

- Repairs vs. improvements: Proper categorization saves thousands

- Professional expenses: Management fees, legal costs, marketing

- Travel deductions: Property visits, market research, education

Successful property management combines market knowledge, operational efficiency, and strategic thinking. By implementing these proven practices, Indianapolis property owners can achieve superior returns while building long-term wealth through real estate investment.

Related Articles

Mike Chen

Investment Strategy Director

Mike has managed over $50M in Indianapolis rental properties and helped hundreds of investors optimize their returns. He specializes in ROI analysis, market positioning, and operational efficiency for residential rental properties.